41+ if filing separately who claims mortgage

Web If you are married and are filing your taxes separately you must follow certain restrictions and rules when deducting the mortgage interest that youve paid throughout the year. You can only take a deduction for the amount you paid.

Pdf A Survey Of Dutch Retirement Migrants Abroad Codebook Version 1 0

Use NerdWallet Reviews To Research Lenders.

. Take Advantage And Lock In A Great Rate. Web When it comes to your federal and state returns both you and your spouse must file the same way. Alternatively if the medical bills belong to your spouse he or she could deduct anything.

Web Just pay the mortgage and property taxes yourself and claim the full mortgage deduction on your return. Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online. Web When you file a joint return you and your spouse will get the married.

Web If you are married and file separately enter on each return the share of mortgage interest for each spouse. Web The mortgage interest will need to be divided based on who actually paid for it. Ad Learn More About Mortgage Preapproval.

Save Real Money Today. Separate returns after joint return. Web If you were the one with the medical bills filing separately just got you a 1875 deduction.

The sum of the two must equal to the amount on. If you only paid a portion of the. Web Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately.

Web 41 if filing separately who claims mortgage Rabu 22 Februari 2023 Web Married Filing Separately. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Head of Household Requirements.

Browse Information at NerdWallet. Figure the credit on Form 8396. Web Separate returns may give you a higher tax.

The IRS does not require you charge your wife rent. Joint return after separate returns. Web You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government.

Either both itemize or both take the standard deduction.

Proof Of Income Letter Examples 13 In Pdf Examples

How To Deduct Home Mortgage Interest When Filing Separately

Was The Dominican Republic Ever Forced To Pay An Independence Debt To Spain Quora

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Chapter 26 City Of Punta Gorda

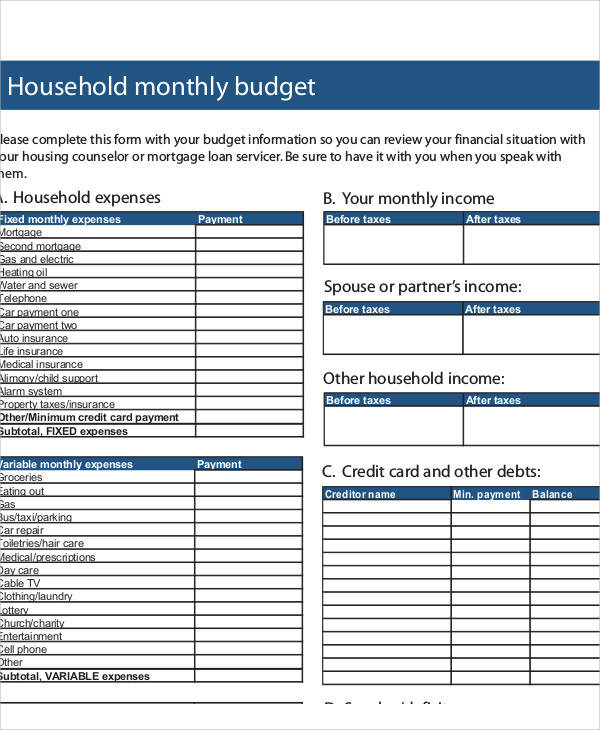

Free 41 Sample Budget Forms In Pdf Ms Word Excel

What To Do With Tax Refund Smartest Ways To Spend Your Tax Refund

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Pdf 7 3 Mb Gildemeister Interim Report 3rd Quarter 2012

How To Deduct Home Mortgage Interest When Filing Separately

Pdf Automatic Identification Of Topic Tags From Texts Based On Expansion Extraction Approach Edward Fox Academia Edu

Student Loans Married Filing Separately White Coat Investor

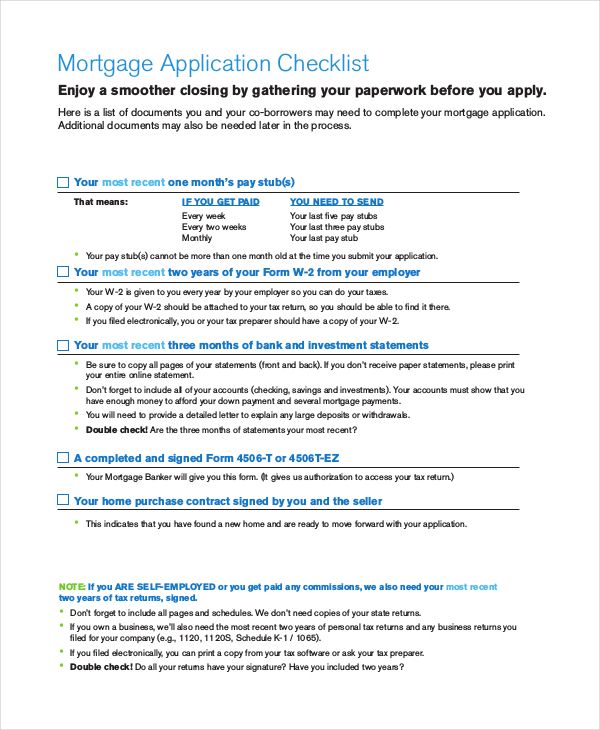

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Using Form 1041 For Filing Taxes For The Deceased H R Block

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Proceedings Of The Lake Malawi Fisheries Management Symposium

Understanding Taxes Simulation Completing A Tax Return Using Married Filing Separately Filing Status